Mobile wallets are also referred to as Digital Wallets or E-Wallets that resolves the huge risk of carrying cash in the pocket. If you want to get rid of the problem of carrying a big amount of cash or if you are fed up with a shortage of cash while shopping then having a mobile wallet in the cell phone can be a lifesaver for you.

Let’s Come To The Quick Definition Of – What Actually Mobile Wallets Are?

What Is A Mobile Wallet Or Digital Wallet ?

A mobile wallet or Digital wallet refers to an electronic wallet service that carries all the financial transactions electronically in a cashless way. In simple words, cashless transactions of money digitally on an online basis are carried out with the help of a mobile wallet. It is a very safe and efficient way of doing transactions while shopping.

Even our honorable Prime Minister insists people to know the importance of mobile wallets and take advantage of this Digital Wallet Technology as much as you can. From the past few years the usage of e wallets is increasing rapidly due to its benefits. A person can carry online as well as offline transactions with the help of these mobile wallets.

The digital movement held by our honorable Prime Minister Mr Narendra Modi, the usage of digital wallets have gained pace and it also helped India to move towards a cashless and developed economy.

Advantages Of Using Mobile Wallet

E wallets are the soft and electronic version of your debit and credit cards. For the functioning of a digital wallet it should be linked with your bank account through which it can make payment efficiently without using cash. There are number of advantages of using mobile wallet for carrying out your payments some of them are listed below

Ease & Convenience To A User

As mentioned earlier mobile wallets provides convenience to users as there is no need of carrying a pocket full of cash while travelling or while making payments. It is quite an easy and quick way of making transactions.

E Wallets Are Device Friendly

E wallet or Digital wallet can be assessed from any kind of device after linking your account to it like you can access it from your mobile phone, laptop, computer system or tablet as per your convenience and choice.

Security-The Top Most Priority

The biggest risk is of fraud and theft in case of cash but Digital Wallets cover for this risk as well. A mobile wallet is a very secure method of paying online. These wallets are tightly secured with the fingerprint or any other biometrics of the user, a secretive pincode aur any other tight medium of security to make it authorised to only a particular user who has right over it.

Can Be Used Anywhere-Anytime

There are no boundaries within your country or no time limit to use a mobile wallet. Hence you can use it anywhere anytime as per your wish. In digital India, almost every shopkeeper for every retailer has an unavailable option of making payment through Digital Wallets.

Rewards And Discounts On Usage

For the encouragement of the users to use a Digital Wallet as much as they can it offers multiple types of rewards and discounts on every transaction. This lets users make more use of rewards and discounts. It also increases the potential of a user to shop more and save more at the same time.

Tracking Of Your Spending Criteria

Many mobile wallets track your money spending criteria and also helps you to stay in your budget while shopping. You can also sign your fixed budget for more restrictions.

Shop Online And Save Big

While doing online shopping one May encounter multiple types of discounts on payments through various e-wallets or Digital wallets. It can only be availed to make payment bi a digital wallet which makes the use of e-wallets more and more it also encourages users to shop online and make payment through e-wallets in order to get discount, reward points and gift vouchers on the shopping.

Top 10 Best Mobile Wallet Or Digital Wallet To Save Money Online

Paytm Digital Wallet

Paytm is widely used and in mentally accepted mobile wallets in India. It has just turned the payment methods of many people through its simple and secure payment method. Paytm wallet was launched in 2010 and it has been used by 180 million of users across India. The payments made by Paytm are almost accepted by every merchant, every institute and every organisation all over India. Multiple activities for which Paytm is being used

For making bill payments

Shopping online or through Paytm app Paytm Mall

For mobile recharge

DTH recharge

Online bus ticket booking

Cab and travel ticket booking

Movie tickets payment

How To Start Using Paytm Wallet App

By just following 3 simple easy steps you can have the advantage of using Paytm app-

1.) Register yourself and verify your account in Paytm wallet

2.) Add money to Paytm wallet by linking your Paytm accounts to your bank account

3.) Pay using Paytm wallet

Along with this Paytm wallet also provides multiple kinds of discounts and rewards on the shopping. It has also different apps for different purposes, for example Paytm bus aur bus ticket booking Paytm sites for flights ticket booking Paytm movie for movie tickets Paytm mall for shopping online and so on.

Amazon Pay Mobile Wallet

We have all done shopping through the biggest ecommerce website that is Amazon. Amazon has also introduced its own mobile wallet which is called as Amazon pay that also never disappoints its customers in terms of making secure digital payments.

Amazon pay was launched in 20017 India. It is accepted by some of the selected margins but it’s easy e and secure method of making transactions makes it very trustful. Amazon Pay also offers multiple kinds of cashbacks and discounts on making payment through Amazon pay mobile wallet. It also allows a user to make a transaction without entering credit card debit card or address information.

Google Pay Digital Wallet

The next Digital Wallet in the list is Google Pay that allows payment with Google security. In spite of rate launching it quickly gained the trust of many people in India and also became one of the Best Digital Wallets in India. Like always it impressed its users with an easy way of making payment and sending money to friends for paying bills but with tight security. It allows a user to make a transaction or receive money e directly e through the bank account or you can say that bank account can directly be assessed with the help of Google pay. It is a very time saving and quick method of making online transactions by using Google Pay UPI.

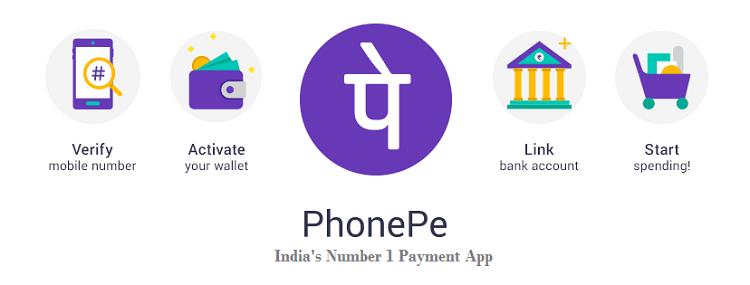

Phonepe Mobile Wallet

Another very popular digital wallet used to save money online is Phonepe. The use of this app is growing day by day due to its increased popularity. Great offers, discounts and cash back deals can be assessed from various Ecommerce websites n making payments through Phonepe. It is also one of the Popular Digital Wallets.

Phonepe is very easy to use and ensures the data security of the users. It is also available in multiple languages as well. Amazing discounts and seamless offers makes it a perfect choice for making online payments.

Freecharge Digital Wallet

Launched in 2010 but today a very popular mobile wallet accepted by much of the population is freecharge. It was one of the easiest ways to make payments and pay your bills online. It can also be used to make offline payments as well.

Freecharge coupons let a customer get exclusive discounts and offers on the usage of freecharge digital wallet. Its services are also available with various financial instruments like investment, insurance, payments etc. Freecharge mobile wallet is accepted by top merchandise and even small shop retailers. It can also let you get profit equal to the amount of payments done.

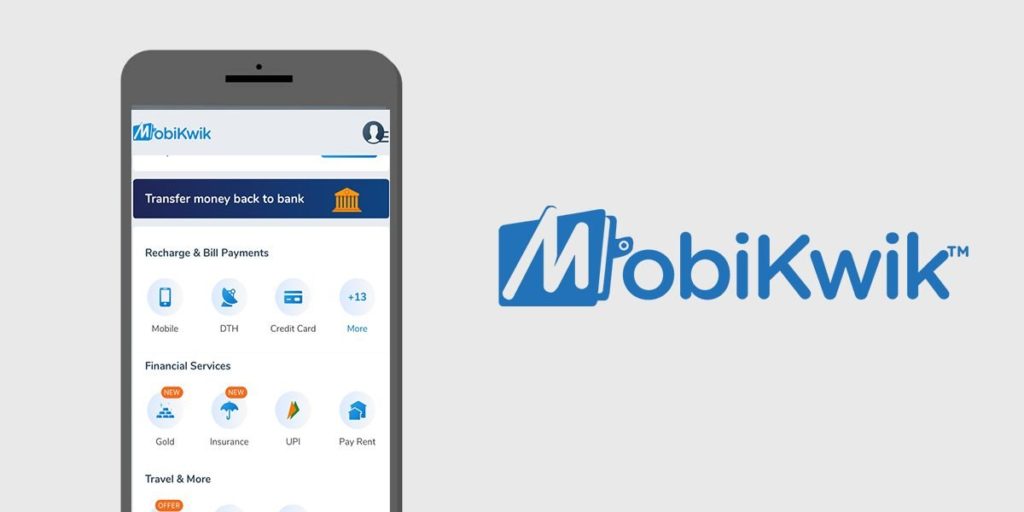

MobiKwik E-Wallet

Mobikwik e wallet was founded by Bipin Singh and Upasana Taku in 2009. It is a mobile wallet payment system that covers a network of approx 20 million plus users with thousands of merchants as their trustworthy payment system among all the Digital Wallets In India. One can make the payment of travel tickets, movie tickets bill payments third party payment with MobiKwik digital wallet. It also allows you to buy insurance and get loan purchasing of digital gold online. One of the Best Digital Wallets In India i.e. MobiKwik lets you invest in mutual funds after linking it to your bank account.

Yono SBI Wallet

Yono SBI is launched by State Bank of India as a mobile wallet. It is available in 10 + languages which allows access to all SBI and non SBI consumers. Users can send money from one bank account to another bank account directly with a YONO SBI Digital Wallet. This mobile wallet also lets you buy movie tickets, hotel tickets, flight ticket booking and third party payments. It is also stated as one of the best mobile wallets in India.

HDFC Payzapp Digital Wallet

With a bundle of offers and deals HDFC payzapp has become the best mobile wallets in India. It has a complete payment system option for paying bills, shopping hotel tickets, slides and much more. By making your payment through HDFC payzapp one can save a lot on the shopping. It also allows you to send and receive money from anyone by just linking your bank account once to HDFC payzapp. It is also one of the secure mobile wallets that can conduct your payments quickly and with complete security.

ICICI Pockets Mobile Wallet

The mobile based application launched by ICICI Bank which is India’s biggest multinational Bank. ICICI pockets is a complete payment act and also one of the Best Digital Wallets in India that makes all the transactions easy.

This app allows you book tickets transfer money e and make various payments in a secure way. In addition to its simplicity of operation it also offers multiple kinds of discounts and deals on its proper usage that can help you to save your money online and spare some extra savings.

BHIM Digital Wallet

One of the most reliable digital wallets that is backed by the Reserve Bank of India. BHIM Mobile Wallet was launched by the Prime Minister of India Mr. Narendra Modi for introducing the concept of cashless economy. The uniqueness of this wallet is that it supports all the banks across the nation to send and receive money e without disclosing your bank details. This feature also makes it very trustworthy and secure.

The authorization of a customer is detected by bio-metrics or through the Aadhar of the customer. It also enables QR scan code for making payment originals with a unique pin code that is UPI pin to assess this app. You can keep track of all your transactions with the transaction history provided by Bhim mobile wallet.

Final Words

The economy of India is leading towards cashless methods of payment for least fraudulent activities. The usage of mobile wallets is widely accepted by the people of India due to its security and simplicity of making transactions. The above shown was the list of top 10 best mobile wallets in India but this is not the end yet. The number of Digital Wallets in India is increasing rapidly to conquer the quest of a cashless economy.

Comment Us With Your Favourite And Best Mobile Wallet That You Prefer To Use And Why?