| Life Insurance Plans | Min/Max Entry Age | Min/Max Policy Term |

| Max Life OTP Plus Plan | 18yrs/60 Years | 10yrs/40 Years |

| LIC e-Term Insurance Plan | 18/75 Years | 10/35 Years |

| ICICI Pru iProtect Smart Plan | 20/75 Years | 10/30 Years |

| SBI Life e-Shield | 18/70 Years | 5/30 Years |

| HDFC Life Click 2 Protect 3D Plus | 18/65 Years | 10/30 Years |

| Aegon Life iTerm Plan | 18/75 Years | 5/40 Years |

| Aviva Life iPlan | 18/55 Years | 10/35 Years |

| Bajaj Allianz eTouch OnlineTerm Plan | 18/70 Years | 10/30 Years |

| PNB Metlife Mera Term Plan | 18/65 Years | 10/40 Years |

| Canara HSBC iSelect Term Plan | 18/70 Years | 5/40 Years |

We live in a digital era, where everyone wants to secure the financial future of the family and for that, you have to buy a good life term insurance policy. It’s not just a policy it’s an investment that you are doing for your loved ones. When you start filling the form of life insurance policy, you have to write the name of the nominee be it your mother, father, brother, sister, husband, wife, anybody whom you loved the most. It’s important to put the name in the nominee, just in case if you died accidentally, your loved ones can claim this policy. No matter which life insurance policies you are choosing for your family protection, this will always give you benefits.

Every customer has its own needs and requirements and for that insurance companies started offering the plans according to their customers. All you have to do is just choose a term insurance plans in India according to your financial requirements of the family. in this blog, I am gonna share the top 10 life insurance policies in India that come in your budget.

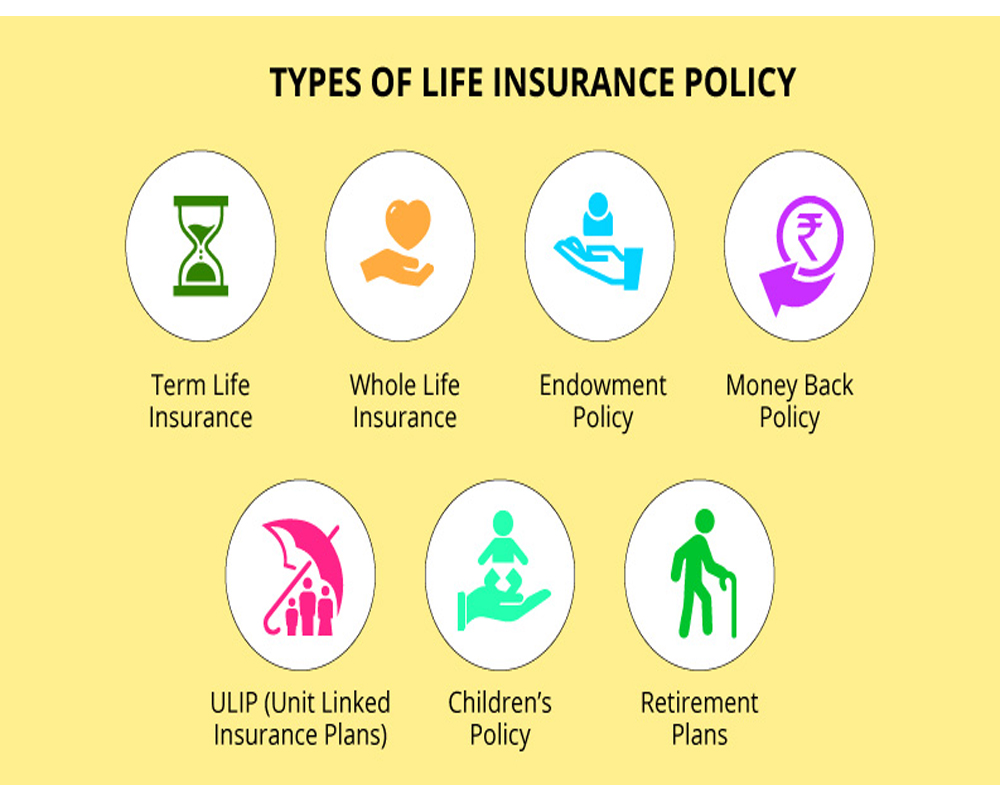

What Is Life Insurance?

Basically life insurance is like a long term investment that comes with amazing benefits. As we all know insurance companies have so many policies, so before choosing any plan its important to check the whole details of the policy. So that you would not regret your decision. Must check your needs and requirements that you want in your policy. Here is the list of top 10 life insurance policies in India that is offered by insurance companies.

Max Life OTP Plus Plan

This plan comes with financial security for your family, in case if you died suddenly. It has three 3 different life cover options i.e basic life cover, monthly life income and increasing life income. When you buy this plan, you will get the comprehensive life cover to 85 years of age. The benefit of this policy is, it will continue always.

Benefits

- Reasonable Plan

- Comes With Three Different Options

- Some Extra Benefits To Enhance The Coverage Of The Policy

- Tax Benefit U/S 80C, 80D, 80DD

- This Best Plan Offers Lower Premium Rate

LIC e-Term Insurance Plan

Another most popular and affordable plan for those peoples who are looking for financial security to their family. It is an online term insurance plan that is very simple and hassle-free. Basically it is a death benefit plan that gives you some additional benefits that no other life insurance policy will provide you.

Benefits

- Best Life Insurance Policies In India

- The plan Offers A Death Benefit

- It Is Totally Simple And Hassle-Free Because You Can Easily Purchase This Plan Online

- Choose Policy Ranging From Minimum 10 Years To Max 35 Years

- This Policy Has Maximum Maturity Of 75 Years

- The Policy Is Under 80C Of Income Tax Act

ICICI Pru iProtect Smart Plan

In your absence, this life term insurance policy secures your family’s financial well being. So choose the plan according to your needs because the plan comes with different options. The plan offers some additional benefits to enhance the coverage of the policy just in case if you have accidental death and you will get the coverage against 34 listed critical illness.

Benefits

- Very Simple And Hassle-Free

- It Provides 4 Death Benefits Like Boost Cover For Death, Disability, Terminal And Illness

- For Females, They Offer Premium Discount

- The Plan Increase The Life Cover At Different Phases Of Life Be It Marriage And Child Birth

- The Policy Has A Claim Settlement Ratio Of 98.58%

SBI Life eShield

One of the most reasonable insurance plans that provide you many different plans as per customer’s requirements. The most amazing feature of this plan Is, it has several benefits such as level cover and increasing cover. This life insurance policy offers inbuilt accidental death cover and additional tax benefits to the policyholders.

Benefits

- Best Life Insurance Plan In India That Comes With Regular Premium Paying Options

- Affordable Plan

- Minimum Entry Of This Policy Is 18+ And Maximum Is 65 Years

- The Policy Maturity Age Is 70 Years

HDFC Life Click 2 Protect 3D Plus

The policy provides full protection of your family at an affordable premium. Basically the term refers to death, disease, and disability which means you will get protection regarding these terms. When you buy this plan online you will get a special discount on a premium account. It has 9 plans so pick the one that suits your requirements.

Features

- In Case You Are No More, The Death Benefit Is Payable To The Nominee

- Tax Benefits Available

- Payment Options Is Available On Both Online And Offline

Aegon Life iTerm Plan

Aegion Life iTerm Plan comes with live coverage of 100 years. It’s an online term plan which is very simple and easy to follow. This life term policy has three different plan options that suit your whole life and

Benefits

- This Plan Is Available On Both Online And Offline

- Maximum Maturity Of The Policy Is 80 Years

- Payment Procedure Is Very Easy

Aviva Life iPlan

It’s the best life insurance policies that offer pure risk cover for your family at a nominal cost. In case if you accidentally demise, under this policy, your family is totally secured because the company will pay the money to your loved ones. All you have to do is just pick the right life cover for your family protection. Apart from this, the plan also gives you tax benefits under section 80C and 10(10D) of income tax act 1961.

Benefits

- In Case If You Died Accidentally, The Sum Assured Will Be Paid To The Nominee That You Have Written In Your Form

- This Policy Comes With Extra Benefits i.e Life Cover, Covers Death By Any Reason, Rebate On High Sum Assured And Much More

- This Insurance Offers Two Different Options For Pay Outs

Bajaj Allianz eTouch Online Term Plan

It is one of the top best life insurance policies that give financial protection to the family of the policyholder at the lowest premium rate. The policy comes with the four different options and everything is under section 80C of income tax Act 1961.

Benefits

- The Plan Offers Low Premium Rate

- It Comes With Under Section 80C And 10(10D) Of The IT Act

- Fill Its Form Online

PNB Metlife Mera Term Plan

Another most popular and trustworthy life insurance policies that offer pure life risk cover and come with various additional benefits. The policy gives you the life coverage of 99 years and then this will fulfill your family protection needs. They have four different types of payouts and have a claim settlement ratio of 96.21% in FY 2018-19.

Features

- It Comes With Four Different Options For Your Family Protection

- It Comes With Several Features

- This Plan Provides The Flexibility To Enhance The Coverage Of The Policy

Canara HSBC iSelect Term Plan

When you are not around this policy gives protection to your family. When you buy this plan you will get the inbuilt terminal illness cover. Choose additional coverage against accidental death and disability.

Benefits

- Best Policy Ever

- This Policy Covers Both Accidental Death And Accidental Disability

- Affordable Price

Check out the Best Online Medicine Delivery App